How to Avoid Foreclosure and Sell Your Home Fast in Texas

Facing the prospect of foreclosure can be a daunting and stressful experience, and according to ATTOM.COM, 95,349 families and individuals across…

Credit Repair: A Path to Re-Purchasing Your Property

In today's financial landscape, maintaining a good credit score is essential, especially for those aiming to purchase or re-purchase a home.…

Maintaining Home Ownership and Equity During Financial Struggles: A How-To Guide

Owning a home is a significant achievement, but financial struggles can put this milestone at risk. The fear of losing…

The Impact of Bankruptcy and Loan Modification on Your Credit

Navigating financial difficulties often leads individuals to consider bankruptcy or loan modification as potential solutions. While these options can provide immediate…

Top 10 Tips for Selling Your Foreclosure Home in Texas

Facing foreclosure can be stressful, but there are steps you can take to navigate this challenge. If you're a Texas homeowner…

Beyond Interest Rates: Hidden Costs to Consider When Refinancing

Refinancing your mortgage can appear as a sign of financial relief, offering the promise of lower interest rates and reduced…

Partnering with a Credit Repair Specialist: Finding the Right Expert

One of the most daunting challenges can be repairing a damaged credit score. Whether due to past financial missteps, errors…

The Truth About Credit Repair: What to Expect and Avoid

Maintaining a healthy credit score is more crucial than ever. However, life can sometimes throw us financial curveballs that damage…

Financial-services-for-foreclosure-prevention

Negotiating with lenders over payment terms can be daunting. However, understanding how to approach these discussions effectively can make a…

The Impact of Medical Debt on Credit Scores: Managing Healthcare Expenses

Medical debt can be a significant financial burden for individuals and families. It's estimated that over 43 million Americans have medical…

An Introduction to Assumable Mortgage

Assumable mortgages are a type of mortgage that allows a buyer to take over the seller's existing mortgage. This can…

Financial Planning for Homeowners: Setting Long-Term Goals

Homeownership is a dream come true for many people. While you may have already achieved this milestone, it's important to…

How to Deal with Missed Mortgage Payments in 2024

Missed mortgage payments can be a stressful and overwhelming experience. Whether it's due to job loss, unforeseen expenses, or other financial…

Credit Repair: DIY vs. Professional Help – Making an Informed Choice

A good credit score opens doors to favorable interest rates on loans, credit cards, and even housing. However, when faced…

Best Strategies To Prove Hardship For Loan Modification

Securing a loan modification can be daunting, particularly when faced with financial hardship. The ability to articulate and document the extent…

What Are My Options if I Can’t Afford my Down Payment?

Struggling to gather funds for a down payment can pose a significant obstacle to achieving homeownership. Many prospective buyers face…

Difference Between a Payment Arrangement and a Debt Management Plan (DMP)

When it comes to debt management, two commonly used financial tools are payment arrangements and Debt Management Plans (DMPs). While…

At What Point Does Stopping a Foreclosure Become Unfeasible?

The looming threat of foreclosure is a distressing reality for many homeowners facing financial difficulties. While there are various avenues…

Good Debt vs. Bad Debt: A Comparison Exemplified

In the realm of personal finance, the terms "good debt" and "bad debt" often spark discussions about responsible financial management.…

Your Complete Guide to a Good Credit Score

In the intricate world of personal finance, a good credit score is your passport to favorable loan terms, low interest rates,…

Navigating Through Financial Trauma: Strategies for Overcoming Challenges

Financial trauma, often triggered by foreclosure threats and credit issues, can be an overwhelming experience that affects every aspect of our…

Foreclosure Prevention Strategies for Homeowners

Owning a home is a significant achievement, but economic challenges can sometimes put that achievement at risk. Foreclosure, the dreaded…

Loan Modification Explained: How It Can Save Your Home

Facing the possibility of losing your home to foreclosure can be an overwhelming and distressing experience. However, there's a potential…

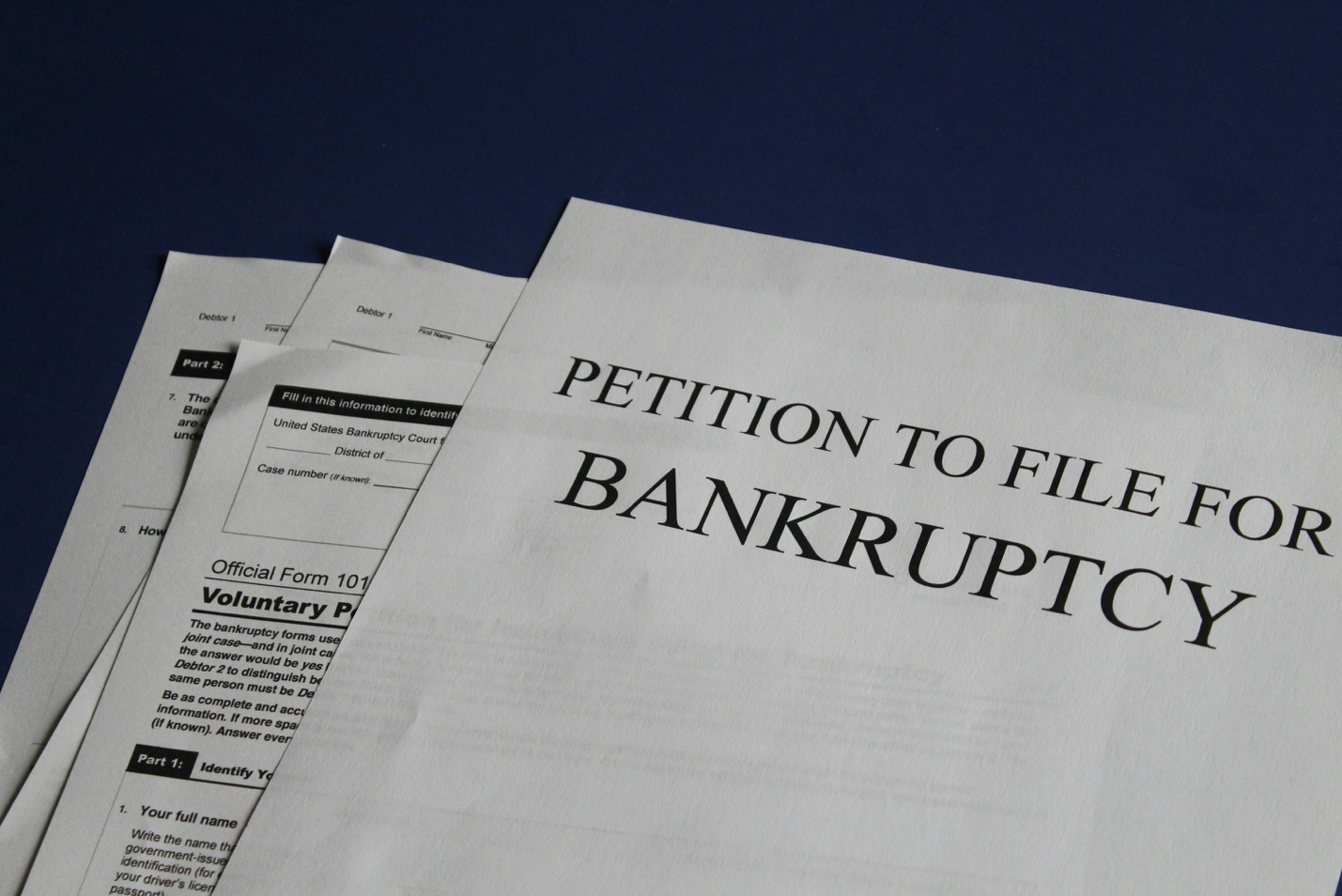

Bankruptcy Avoidance Strategies: Tips for Financial Stability

Facing financial difficulties can be overwhelming, and the prospect of bankruptcy may seem like an impossible challenge. However, with proactive…

Recovering Lost Investments: Strategies for Investors

Investing is inherently accompanied by risks, and losses can be an inevitable part of the journey. However, the key lies…

Is Filing for Chapter 13 Bankruptcy a Good Idea?

To decide whether you should declare bankruptcy is a tricky decision. The decision affects not only your future credit but…

![Celebrities Who Faced Foreclosure [Part 2]](https://www.recoveringallinvestments.com/wp-content/uploads/2020/09/image-31.png)

Celebrities Who Faced Foreclosure [Part 2]

There is more to popular celebrity culture than paparazzi, red carpet, Oprah's show, and winning Grammy's. There is more to…

![Celebrities Who Faced Foreclosure [Part 1]](https://www.recoveringallinvestments.com/wp-content/uploads/2020/09/image-28.png)

Celebrities Who Faced Foreclosure [Part 1]

All that glitters is not gold. From a fan’s perspective, the life of a celebrity seems glamorous and genuinely extravagant.…

Refinancing: The 3 Credit Scores You Should Know Before

The Federal Reserve’s efforts to fund financial markets in order to support the economy during the COVID-19 crisis have led…

A Rundown of Mortgage Closing Costs

After saving up for your down payment, going house hunting, and then finally applying for a mortgage, dealing with closing…

Facing Foreclosure? 3 Ways to Stop It in Its Tracks

A foreclosure is a pretty daunting prospect. In 2019, the share of housing units with a foreclosure filing was 0.36%.…

COVID-19: Evaluating How the Pandemic Has Affected Your Financial Habits

The COVID-19 pandemic has fundamentally restructured our lives, whether we like it or not. In just a matter of months,…

Paying Off Your Mortgage Early: 3 Simple Ways

An Urban Institute report released in 2016 revealed that over 26.9 million people in the US own their homes outright. While…

3 Reasons Why You Should Work With a Credit Repair Company

A bad credit score doesn’t just prevent you from getting a credit card or applying for a loan. It can…

How Does Filing For Bankruptcy Impact Your Credit History

There’s a reason why bankruptcy is considered to be a financial Armageddon. It’s a last resort move used to clear…

Falling Interest Rates – Is This The Best Time To Invest in Real Estate?

The unprecedented times brought on by the COVID-19 pandemic have led to developments we wouldn’t have thought were possible half…